kentucky inheritance tax calculator

How much money can you inherit without paying inheritance tax. Kentucky Inheritance Tax Calculator calculator inheritance kentuckyEdit For any amount over 12500 but not over 25000 then.

How Is Tax Liability Calculated Common Tax Questions Answered

The calculator on this page.

. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax. In 2021 this amount was 15000 and in 2022 this amount is 16000. It is one of 38 states in the country that does not levy a tax on estates.

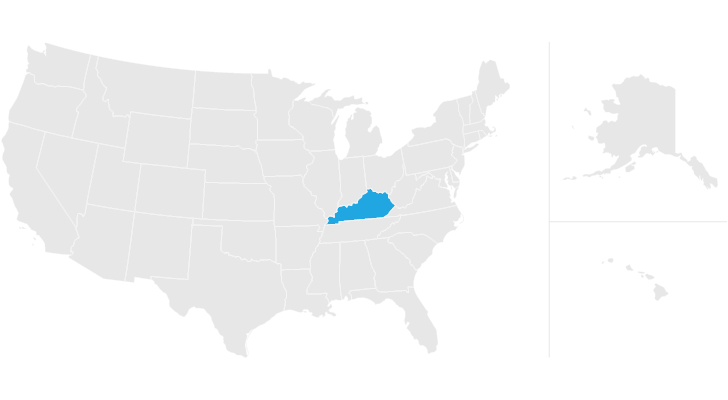

The Class C group can end up paying tax rates anywhere from 6 to 16. All other individuals related or unrelated will pay between 8 and 12 of their inheritance. Kentucky is one of seven states that has it inheritance tax.

Each California resident may gift a certain amount of property in a given tax year tax-free. Thereafter the amount of the legacy is taxed at rates ranging from six to 16 percent. Class A beneficiaries pay no taxes on their inheritances.

Ad Download Or Email Form 92A200 More Fillable Forms Try for Free Now. Legacies to Class C beneficiaries are exempt up to 500. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

For Class C members only 500 is exempt from Kentuckys inheritance tax. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000. When a Kentucky resident dies without a last will and testament the intestacy succession laws will dictate who inherits the deceased persons probate estate.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. As you can imagine there are nuances to this tax beyond those which can be explained here. Updated for the 2021-22 tax year.

This calculator does not take into account Residential Nil Rate Band RNRB or any gifts you have made in your lifetime particularly within. There is no estate tax in Kentucky. While they do assess an income tax and of course real estate taxes there is no estate tax.

Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. The highest property tax rate in the state is in Campbell County at 118 whereas the lowest property tax rate in Kentucky is 056 in Carter County. Laws can be confusing so perhaps the best place to start is by defining a few of the terms you will see.

Complete the information in the calculator to see how much your family could be liable to pay in IHT tax to HMRC when you die. The major difference between estate tax and inheritance tax is who pays the tax. Kentucky inheritance taxes Kentucky has an inheritance tax ranging from 4 to 16 that varies based on the beneficiarys relation to the deceased.

Mortgage Calculator Rent vs Buy. The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000. A last will and testament is a document that a person completes.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. It may be possible to minimize the inheritance tax with an alternate estate planning device which can be explored by consulting a qualified estate planning attorney. Important note on the salary paycheck calculator.

Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. If you have additional questions about Kentuckys inheritance tax please do. Citizens of Kentucky.

Kentucky inheritance tax calculator. The calculation of the inheritance tax depends on what class of heir you fall under and the net estate amount. There are three classes of beneficiaries in.

Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Class B beneficiaries pay a tax rate that can vary from 4 to 16. Estimate the value of your estate and how much inheritance tax may be due when you die.

If the gift or estate includes property the value of the property is. How Much Is the Kentucky Inheritance Tax. The amount of Kentucky inheritance tax depends on the class of beneficiary and varies significantly with the amount that is left to the beneficiary.

Our Inheritance Tax Calculator is designed to work out your potential inheritance tax IHT liability. After that the tax rate falls between 6 and 16. An inheritance tax is usually paid by a person inheriting an estate.

The inheritance tax in this example is 76670. Jefferson County Ky Property Tax Calculator - Smartasset Class a beneficiaries pay no taxes on their inheritances. It does have an inheritance tax however.

Kentucky is one of seven states that has it inheritance tax. The good news is that there are lots of ways to cut down your bill which. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Kentucky is a reasonably friendly tax state.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Calculating Inheritance Tax Laws Com

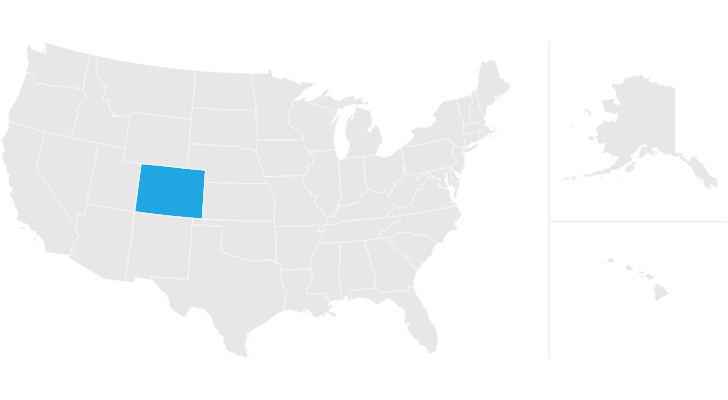

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Inheritance And Gift Taxes In Connecticut And Other States

Kentucky Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

How To Calculate Inheritance Tax 12 Steps With Pictures

How To Calculate Inheritance Tax 12 Steps With Pictures

Ulise Funcționare Posibilă Mexic How Much Inheritance Tax Will I Pay Calculator Johnveliz Com

How To Pay Off Your Mortgage 10 Years Early And Save 72 000

How Does The U S Inheritance Tax Work Quora

Inheritance Tax On House California How Much To Pay And How To Avoid It

Kentucky Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kentucky Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Can I Pay For School Fees Out Of Income

Florida Estate Tax Rules On Estate Inheritance Taxes

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips